This article was originally published in French by The Conversation, under a Creative Commons license.

Declaration of interest: Bpifrance has funded access to the services of the Centre d’Accès Sécurisé à Distance (CASD).

SMEs Encourage Innovation

Innovative small and medium-sized enterprises play a central role in countries’ economic growth paths. Indeed, a study has shown that they drive technological change because they bring more innovative products and services to the market. It therefore appears vital for these businesses to have access to external funding (banks, venture capital, etc.) so that they can fulfil their potential and in due course replenish France’s industrial fabric.

But They Struggle to Secure Funding

In reality, SMEs suffer from what are termed “funding constraints” because of capital market imperfections. This is mainly due to asymmetry of information between innovative SMEs and the lenders they approach. An innovative SME has far more information about its project and its chances of success than external investors. In addition, it is not in an innovative company’s interests to provide strategic information about its project due to the risk of leaks from which rivals could benefit.

Consequently, potential investors will demand a higher risk premium to fund the project. Moreover, this premium is higher for an innovative project than it would be for an investment in equipment (a machine purchase, for example), because it is difficult to distinguish between a “good” innovation project and a “bad” one.

Resource Effect and Certification Effect – What Impact Do Public Policies Have on Innovation?

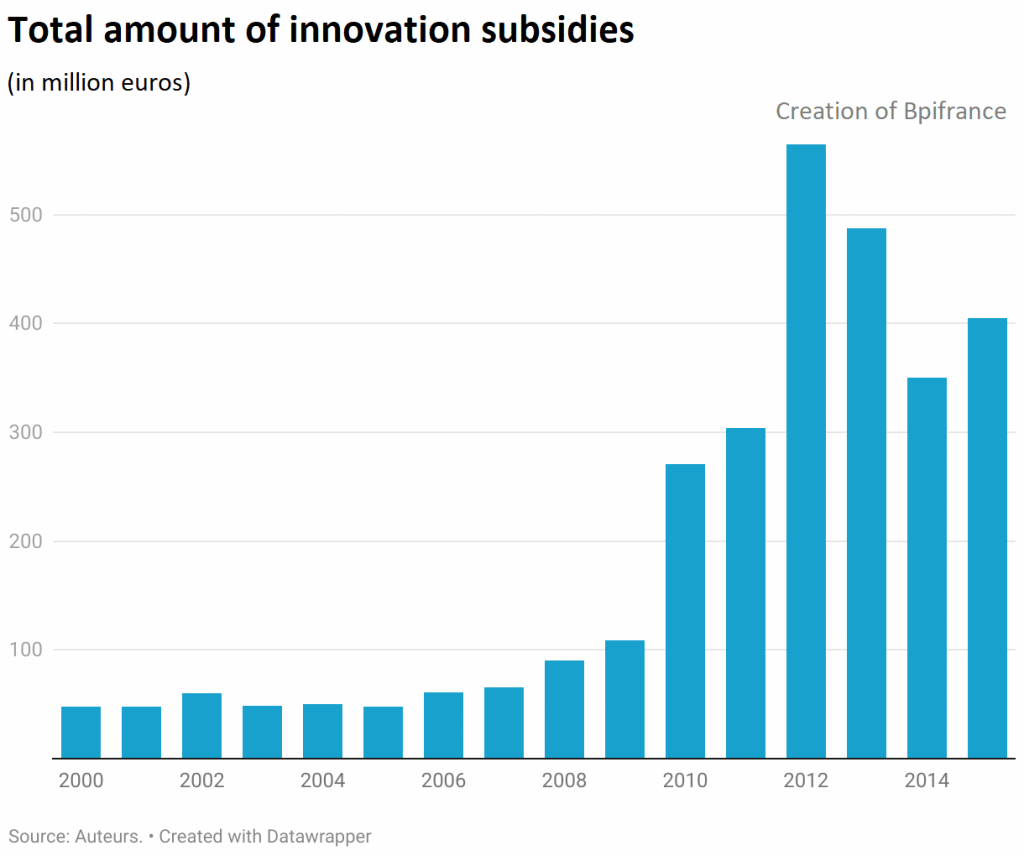

There have been an increasing number of public initiatives to reduce the funding constraints facing SMEs in most European countries and in the USA since 2008. Support can take the form of subsidies, repayable loans, tax credits, etc. In France, since the 2000s there has been a series of different agencies responsible for allocating public funds to support innovation. The value of subsidies allocated to innovation has risen sharply since Bpifrance was created in 2012 by merging Oséo, Caisse des Dépôts et Consignations Entreprises and FSI, the strategic investment fund. It is therefore appropriate to evaluate the effectiveness of this public support.

In a study published recently in the journal Research Policy covering the period 2000-2014, we show that the subsidies granted successively by Anvar (the national agency for the promotion of research), Oséo and Bpifrance had a positive effect on the ability of SMEs to access loans. Our estimations highlight that companies that received an innovation subsidy from one of these three organisations had significantly increased their debt ratio (bank debt as a percentage of total assets) two years after the subsidy was received. The effect is nevertheless variable and appears to be focused on companies that are young (less than seven years old) and smaller (micro or small businesses).

We also demonstrated that this positive impact results mainly from the certification effect. From a theoretical point of view, there are two mechanisms which could explain how an innovation subsidy would improve a company’s access to external funding: (i) the “resource” effect and (ii) the “certification” effect.

The “resource” effect refers to the fact that a subsidy increases the company’s financial capacity. It will be able to use the funds it has obtained to finance its investments. The existence of this effect has been demonstrated in an evaluation of American R&D subsidies.

The “certification effect” refers to the fact that a subsidy can create an indirect (or second round) effect in terms of access to funding. The idea is that a subsidy awarded to a company as part of a competitive process acts as a positive signal for potential investors. Of course, for this effect to operate, the subsidy allocation process needs to be competitive and the public body in charge of awarding it must have recognised expertise.

Conversely, we did not observe a significant effect on the shareholders’ equity ratio (shareholders’ equity as a percentage of total assets) for French SMEs that had secured an innovation subsidy. This result is explained by the fact that, although there is also a certification effect for equity investors (business angels, venture capital funds, etc.), it is not strong enough to counterbalance the increase in the recourse to bank debt within the capital structure of the businesses after the subsidy has been obtained.

This is because French SMEs continue to rely heavily on bank loans, their main source of funding.

Displaying Support from Public Institutions to Attract Quality Investors

The lack of access to external funding for innovative SMEs therefore remains a major public policy issue, since financial constraints can result in under-investment in research and development (R&D) and weigh on growth prospects. There is therefore clear justification for specific public policies to boost R&D and innovation within SMEs by reducing the financial constraints they face.

In France, the various institutions successively responsible for supporting innovation have proved that their expertise can send positive signals to external investors and facilitate the funding of projects initiated by SMEs. However, the signal sent by the awarded subsidy seems to carry more weight with banks than with equity investors.

Consequently, a number of recommendations can be made to improve the signal effect for equity funding. Firstly, we can imagine that the effect would be amplified if the organisation improved its communication, in particular as regards the criteria used to select projects to be funded. Secondly, boosting partnerships with private investors would also strengthen the signal. For example, a systematic partnership could be created with external investors to increase the proportion of projects financed or the number of businesses subsidised. This could attract external investors, reduce moral hazard for these investors and reinforce the certification effect.

It would then be important to be vigilant regarding the quality of these investors, and in particular their willingness to invest for the medium term.