Founded in 2012, the International Observatory on Sustainable Finance (OIFD) is part of SKEMA Business School and aims to:

- Observe and promote sustainable finance practices within financial institutions through partnerships and meetings with finance professionals, including BpiFrance, the French Banking Federation and Paris EUROPLACE, as well as international actors such as the departement for Green Economy and Blue Economy of the United Nations Economic Commission for Africa (ECA).

- Contribute to public debates on sustainable finance practices by soliciting expert opinions and writing policy briefs and articles, disseminated through a partnership with the publisher Revue Banque.

- Promote academic research in sustainable finance.

- Create, test and implement sustainable finance indices to monitor sustainable finance practices.

Upcoming events

- May 2025 – The OIFD will participate at the “third Sustainable Finance meeting” in Dakar, Sénégal.

Past events

- May 2024 – The OIFD participated in the “second Sustainable Finance meeting” at the Faculty of Economics and Management of Sfax, Tunisia, on 10-11 May 2024. The Meeting focused on climate risks in Africa. The conference featured a program with over 40 domestic and international speakers, both academic and professional, and 10 research workshops. Professor Christian de Boissieu was the guest of honor at this second edition. Topics covered included the twin transitions: ecological and digital, climate risk financing, climate injustice, CSR and sustainable finance, impact measurement, ESG standards and labels, as well as green cryptocurrencies and artificial intelligence.

- October 2023 – The MSc in Sustainable Finance & Fintech (MSc SFF) signed an academic partnership titled “committed to sustainable finance” with Institut de la Finance Durable (IFD) and Institut Louis Bachelier (ILB).

- July 2023 – The OIFD participated in the Africa-Spain Cooperation Summit 2023, marked by the impulse of “Afroptimism”.

- May 2023 – The OIFD organised Rabat’s first “Sustainable Finance Meetings” on May 19th, 2023 at the CNRST, chaired by Ms. Leïla Benali, Minister for Energy Transition and Sustainable Development, in collaboration with the ISCAE Group, bringing together the ORSEM (Observatoire de la RSE au Maroc), the ISCAE Group’s Centre for Doctoral Studies (CEDOC), the CNRST (Centre national pour la recherche scientifique et technique), the Casablanca Stock Exchange, the Tunis Stock Exchange and the Institut des hautes études de Tunis (IHET).

- November 2022 – The OIFD held a conference on “Sustainable finance: governance and metrics” in partnership with BpiFrance and SKEMA Publika in Paris.

A multidisciplinary team in sustainable finance

Director of MSc SFF, SKEMA Business School

Director of Sustainable Development and CSR, Bpifrance

OIFD, partner of SKEMA Publika

The objective of this partnership is to influence decision-makers and to participate in public debates on sustainable finance. It has three components: the technological component (Mihaly PETRECZKY), the sustainable finance/CSR component (Sana BEN ABDALLAH) and the ethical/regulatory component (Diane de SAINT-AFFRIQUE). Two notes were published in this context:

- SAÏDANE, D. and BEN ABDALLAH, S. (2021). “Democracy Operates through Businesses too“

- DE SAINT-AFFRIQUE, D. & SAÏDANE, D. (2021). “More Sustainable Finance: Self-Regulation for Businesses with Smart Law“

Fintech for impact measurement (2022)

In order to help companies improve the quality of their reporting, the OIFD is working on the creation of a Sustainable Performance Index (SPI): the SPI score Fintech. Based on a multi-criteria model, it aggregates various financial and non-financial criteria as well as satisfaction levels of various stakeholders. It is based on all dimensions of sustainability : environmental, social and economic. The indicator produced measures the degree of sustainability of a company. It identifies a company’s weaknesses and strengths vis-à-vis its stakeholders and invites it to consider the necessary actions to improve stakeholders’ level of satisfaction. The OIFD is currently working with BDMG Bank in Belo Horizonte, Brazil to measure its SPI.

Launch of the MSc Sustainable Finance & Fintech (2021)

SKEMA Business School and the OIFD launched a new programme in Sustainable Finance and Fintech in September 2021.

Nine organisations partenered with SKEMA to create this programme:

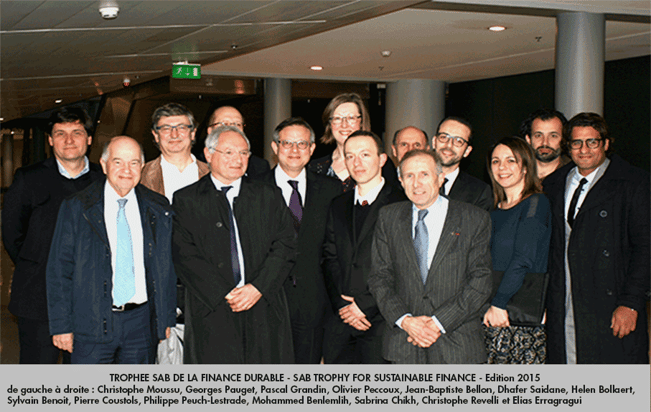

SAB Trophy (2013-2015)

The SAB Trophy for Sustainable Finance was an initiative created in 2009 and launched in 2013 by the OIFD in partnership with the banking software international group SAB 2i (headed at the time by Olivier PECOUX) and the publisher Revue Banque. Until 2015, this annual prize, whose jury was co-chaired by Georges PAUGET, former CEO of Crédit Agricole, and Alice GUILHON, Dean and Executive President of SKEMA Business School, rewarded the best scientific works on sustainable finance. Its objective was to accompany and understand the transformation of global finance.

2013 Laureates

- Isabelle GIRERD-POTIN

- Gunther CAPELLE-BLANCARD

- Marion DUPIRE-DECLERCK

- Sabrina CHIKH

2014 Laureates

- Knar KHACHATRYA

- Mohammed BENLEMLIH

- Lyes KOLIAI

2015 Laureates

- Sylvain BENOIT

- Mohammed BENLEMLIH et Mohammad BITAR

- Christophe MOUSSU et Steve OHANA

- Christophe REVELLI et Elias ERRAGRAGUI

Publications

GRANDIN, P. and SAÏDANE, D. (Dir.) La finance durable. Une nouvelle finance pour le XXIe siècle?, RB Edition, published in November 2011. Prix Turgot 2012 awarded by the French Minister of Finance.

- SAIDANE, A. (2024). “New observatory aims to highlight Africa’s climate finance deficit”. African Business. https://african.business/2024/06/finance-services/new-observatory-aims-to-highlight-africas-climate-finance-deficit

- SAÏDANE, D. (2024). « Les grandes mutations à venir de la banque africaine ». NewAfrican. https://magazinedelafrique.com/african-banker/les-grandes-mutations-a-venir-de-la-banque-africaine/

- SAÏDANE, D. (2023). “The injustice of climate change: What solutions for Africa?”. African Business. https://african.business/2023/10/resources/the-injustice-of-climate-change-what-solutions-for-africa

- SAÏDANE, D. and BEN ABDALLAH, S (2021). “African firm default risk and CSR”. Finance Research Letters, vol. 43. https://www.sciencedirect.com/science/article/abs/pii/S1544612321000453

- SAÏDANE, D. and BEN ABDALLAH, S. (2021). “Sustainable Finance: Concepts, Analyses and Perspectives”, in BOURGHELLE, D., PÉREZ, R. and ROZIN, P. (Ed.) Rethinking Finance in the Face of New Challenges (Critical Studies on Corporate Responsibility, Governance and Sustainability, Vol. 15), Emerald Publishing Limited, Leeds, pp. 181-192. https://doi.org/10.1108/S2043-905920210000015028

- SAÏDANE, D. and BEN ABDALLAH, S. (2021). « Quelle relation causale entre stabilité financière et RSE ? Une comparaison Afrique – Europe « . Entreprise & Société, n°9, pp. 125-148. https://classiques-garnier.com/entreprise-societe-2021-1-n-9-varia-quelle-relation-causale-entre-stabilite-financiere-et-rse.html

- SAÏDANE, D. and BEN ABDALLAH, S. (2020). “Sustainability and Financial Stability: Evidence from European Banks”. Economics Bulletin, vol. 40(2), pp. 1769-1780. https://ideas.repec.org/a/ebl/ecbull/eb-19-00984.html

- BEN ABDALLAH, S., SAÏDANE, D. and BEN SLAMA, M (2020). “CSR and banking soundness: A causal perspective”. Business Ethics: A European Review, vol. 29(4), pp. 706-721. https://onlinelibrary.wiley.com/doi/abs/10.1111/beer.12294

- CHIKH, S., TRABELSI, D., GOGUEL, A., and SAÏDANE, D. (2019). “Do the shareholders take into account the eco-efficiency factor? Evidence from M&A announcement”. Bankers, Markets & Investors, vol. 156, n°1. https://journaleska.com/index.php/bmi/article/view/305

- BEN ABDALLAH, S., BEN SLAMA, M., FDHILA, I. and SAÏDANE, D. (2018). « Mesure de la performance durable des banques européennes : vers un reporting intégré ». Revue d’Economie Financière, n°129, pp. 269-297. https://www.cairn.info/revue-d-economie-financiere-2018-1-page-269.htm

- AZIZ, S., CHICKH, S., DOWLING, M. M. et TRABELSI, D. (2018), “Committing to Widespread Disclosure of Carbon Impact”. Bankers, Markets & Investors, vol. 154-155, 1-13. http://dx.doi.org/10.2139/ssrn.3157120.

- REBAÏ, S., AZAIEZ, N. and SAÏDANE, D. (2016). “A multi-attribute utility model for generating a sustainability index in the banking sector”. Journal of Cleaner Production, vol. 113, pp. 835-849. https://www.sciencedirect.com/science/article/pii/S2212567112000986

- REBAÏ, S., AZAIEZ, N. and SAÏDANE, D. (2014). “Sustainable Finance and Sustainable Banking: Conceptualization”.

- REBAÏ, S., AZAIEZ, N. and SAÏDANE, D. (2014) “Banking Performance Evaluation Towards a Sustainable Bank: A Multi-attribute utility Model”.

- REBAÏ, S., AZAIEZ, N. and SAÏDANE, D. (2012). “Sustainable Performance Evaluation of Banks using a Multi-attribute Utility Model: An Application to French Banks”. Procedia Economics and Finance, vol. 2, pp. 363-372. https://www.sciencedirect.com/science/article/pii/S2212567112000986

- SAÏDANE, D. and PAUGET, G. (2011). « Pour une définition de la banque universelle durable », in GRANDIN, P. and SAÏDANE, D. (Dir.) La finance durable. Une nouvelle finance pour le XXIe siècle?, RB Edition, pp. 107-122.

- SAÏDANE, D. and PAUGET, G. (2010). « Firme bancaire : quel nouveau paradigme après la crise ? », Revue d’économie financière, vol. 100(4), pp. 223-250. https://ideas.repec.org/a/prs/recofi/ecofi_0987-3368_2010_num_100_4_5833.html

- SAÏDANE, D. and PAUGET, G. (2010). « Finance durable – La banque de l’après-crise : vers un nouveau paradigme ? ». Banque et Stratégie, n ° 286. https://www.revue-banque.fr/archive/banque-apres-crise-vers-un-nouveau-paradigme-YYRB08274

Contact

Dhafer SAÏDANE, Director of the OIFD : dhafer.saidane@skema.edu